Moody’s warns public school finances will deteriorate as experts ring tax revolt alarms

The world’s premier financial rating service issued a report that warns school districts they will be facing increasing financial problems due to shifting conditions in the “education operating…

The world’s premier financial rating service issued a report that warns school districts they will be facing increasing financial problems due to shifting conditions in the “education operating environment.”

The Moody’s Ratings report said that the end of “extraordinary” federal funding, long-term plunging enrollment, and increasing salary costs, which have risen faster than the private sector, will end what it called “an exceptionally favorable operating environment over the past few years” for K-12 public schools.

The result will not just be more expensive school bond ballot issues in the future, but more school districts appealing to municipal politicos and state legislators for more tax dollars from voters who could be on the edge of a tax revolt, say experts and politicians.

This largely comports with an analysis of K-12 public school district financial conditions published by The Lion in January.

“Districts’ ability to respond will depend in large part on their willingness and ability to wind down programs funded with federal aid, the flexibility provided by their state operating environment and if they were able to add reserves in recent years,” Moody’s said.

School districts received a big bump in cash from the infusion of $190 billion in emergency funding from the federal government, known as ESSER funds, due to the COVID-19 crisis.

But that funding has ended, and there is nothing on the horizon to replace it.

“Districts that used ESSER funds on programs that officials perceive as crucial to maintaining student outcomes will face the most significant challenges,” said Moody’s.

In the analysis published by The Lion in January, experts warned that school districts faced a “bloodletting” due to the expiration of ESSER funding.

That’s because some districts around the country used the temporary COVID-19 relief funds for permanent budget items such as teachers’ raises and increased staffing, which could eat into reserves.

Moody’s also notes declining enrollment in public schools is also contributing to further deterioration in school financial conditions. Lower enrollment figures are the consequence of “falling birthrates and the resulting decline in the school-age population,” the report said.

“Alternatives such as charter schools, home schooling and private schools are likely to continue drawing enrollment from public schools. Open enrollment policies meanwhile are increasing competition between districts,” said Moody’s.

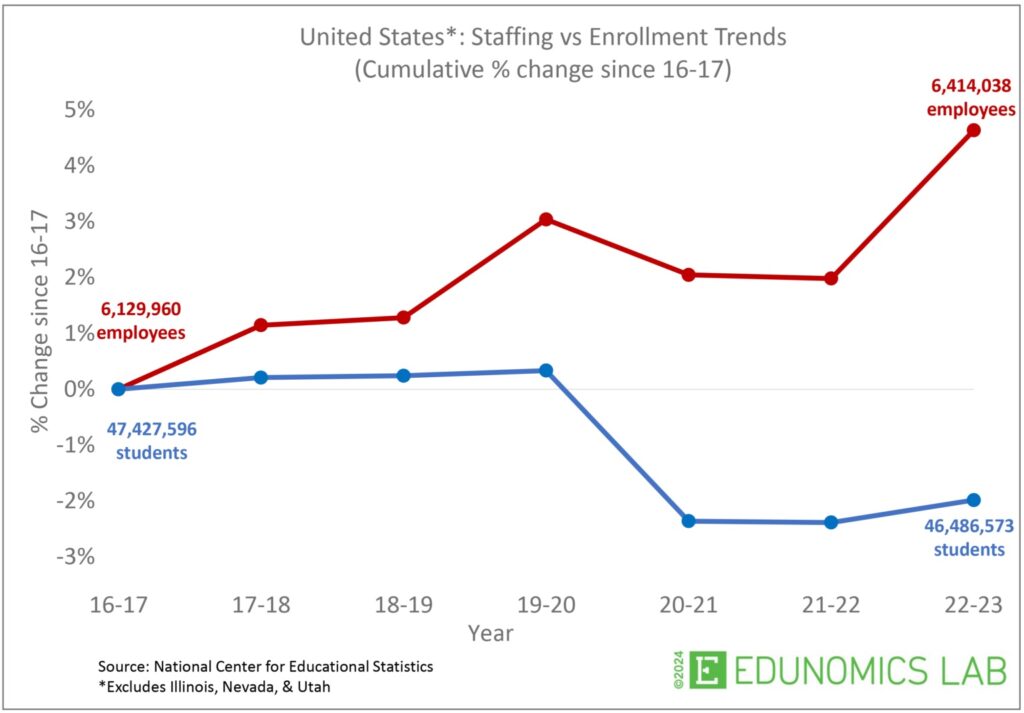

Salaries and staffing have also increased above pre-pandemic levels in public education.

“The cost of employing K-12 teachers and other staff is now growing slightly faster than the private sector,” said the report.

In fact, even as enrollment declines, Edunomics Labs reports that staffing levels for K-12 schools are higher than ever before.

Pennsylvania schools, for example, have experienced more dramatic rises in staffing levels compared to other states in the Edunomics report. And in Philadelphia, union teachers have scored a 9% pay raise.

As a result, the School District of Philadelphia now projects the deficit of $88 million for 2025 to expand to $745 million by 2029, according to the Philadelphia Inquirer.

The deficits in Philadelphia will be settled each year by eating into reserves, reports ChalkBeat.

Nationwide, rainy-day funds and reserves peaked in 2022 due to the infusion of federal funds for K-12 schools, said Moody’s.

The dwindling reserves, extra expense and lower enrollment will make the financial condition for some school districts weaker, the financial group warned.

In addition, property tax fatigue could create even more problems for districts, which Moody’s fails to mention.

Property owners around the country are beginning to engage in mass appeals over property tax increases from rising property assessments.

“From California to New York, the people who pay taxes and fees are pushing back” on higher assessments in a movement the Wall Street Journal likened to a property tax revolt.

That has implications for school districts that will eventually be decided by voters.

Reliably liberal bastions like Washington state and Chicago are ringing the “tax revolt” alarms.

In Seattle’s King County – where President Joe Biden received 75% of the vote in 2020 – Property Tax Assessor John Wilson even asked, “Are we on the brink of a tax revolt?”

Homeowners in deep blue, Democrat Chicago are asking a similar question. “How much more can Chicago homeowners pay before they turn as red as their bank balance?” asked Crain’s Chicago Business about more property tax increases to fund public schools.

“There should be great concern, or at least great interest. There could be a substantial whack coming,” Joe Ferguson, president of the watchdog Civic Federation in Chicago told the newspaper.

That “whack” means higher bond costs for school districts and petitioning at the municipal level and at state capitols for funds schools can’t get from the federal government.

That could mean a tax revolt that further weakens the financial condition and trust of the underperforming K-12 public school system nationwide.