Kansas school board to debate budget with a 24% property tax hike

(The Sentinel) – Taxpayers in Lansing, Kansas, will likely seek answers when they gather to hear a presentation on the local school district’s 2024-2025 budget that calls for a 24% property tax…

(The Sentinel) – Taxpayers in Lansing, Kansas, will likely seek answers when they gather to hear a presentation on the local school district’s 2024-2025 budget that calls for a 24% property tax increase.

A year ago, an 11th-hour switched vote by Board Member Mary Wood to adopt a revenue-neutral property tax position for the 2023-24 budget saved taxpayers, but Superintendent Marty Kobza wants a 24% hike for the 2024-25 school year.

We asked Kobza how he justifies a 24.5% tax increase on the amounts decided by the school board considering that:

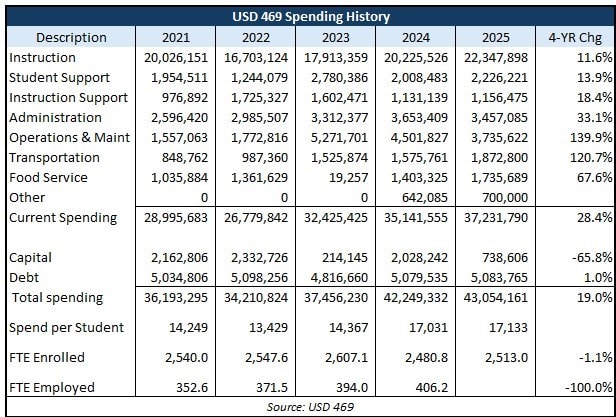

- Administration spending increased by about $1 million (33%) since 2021, when enrollment has declined

- Employment is growing while enrollment is declining (no data is available for 2025)

- Operations and Maintenance is 140% higher than in 2021

We also asked for an explanation of new “Other” expenses and why the district is increasing the Bond & Interest property tax by more than 75%.

Kobza did not respond to our questions. This summer, without authorization from the school board, he donated $400 in school funds to the “Lip-Sync Battle” sponsored by the Leavenworth-Lansing Chamber of Commerce and benefitting area scholarships.