Kansas superintendent uses property tax deception to oppose open enrollment

(The Sentinel) – Comments made at the Lansing, Kansas school board meeting on Nov. 13 exposed a consciously false claim and several school funding deceptions by USD 469 Superintendent Marty Kobza…

(The Sentinel) – Comments made at the Lansing, Kansas school board meeting on Nov. 13 exposed a consciously false claim and several school funding deceptions by USD 469 Superintendent Marty Kobza as he tried to sway board members to oppose open enrollment.

Kobza was promoting a 2024 legislative agenda developed by all the superintendents in the county that includes objections to the open enrollment law going into effect in the 2024-25 school year. Many superintendents object to students being able to attend a public school of their choice regardless of where they live; as is often the case, the system’s needs are prioritized over students’ needs.

Kobza argues that Lansing taxpayers would be footing the bill for kids who choose a school in USD 469, saying that the state only provides $5,080 and the district spends “a little over $11,000,” and “it takes more than just the state aid that we receive on a student to fund their education and then that’s picked up by the taxpayers in your district.”

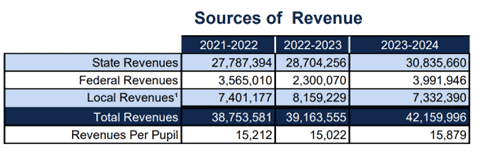

The district’s budget report shows Kobza’s statements to be blatantly false. USD 469 is budgeting $42.2 million in total revenue this year, of which $30.8 million comes from state revenues; with 2,665 students budgeted, that is $11,614 per student from the state. The district is budgeting to spend almost $16,000 per student this year, not $11,000 as Kobza told the board. State revenue accounts for 73% of total revenue, 9% comes from federal sources, and 17% is local revenue.

Kobza implied that local taxpayers provide about $5,900 per student ($11,000 minus $5,080), but the number in his budget is $2,762. Further, a large portion of the local money is for bond payments and capital outlay taxes, which would not change if students transferred in from another district via open enrollment.

The $5,080 Kobza cites is just the base aid for each student; weightings on top of base aid should add another $1,100 based on last year’s distribution. The State also provides aid that is not distributed on a per-student basis, including special education, staff retirement, and supplement aid for capital outlay and bond payments.

More deception on ‘who pays’ in open enrollment

School officials who oppose open enrollment say taxpayers in the receiving district will be paying extra property tax to educate students coming into the district. What they neglect to mention is that any extra property tax is at the discretion of the local school board.

As mentioned earlier, some costs funded by the state are not provided on a per-student basis, so staff retirement costs and supplemental aid for capital outlay and bond payments are unaffected by students transferring in. The same is true of property taxes imposed by school districts for capital outlay and bond payments; those taxes are determined by property values in the receiving district.

Per-student funding for base aid and the extra weightings and special education funding from the state are eligible for extra Local Option Budget property tax dollars, but local school boards could reduce their mill rate to effectively prevent the extra tax from being collected. That part wasn’t shared with the board.

Special education is fully funded, but the formula is flawed

Kobza also misled the board about special education funding. The law calls for districts to be reimbursed for 92% of special education costs not provided by federal funds and state aid for the regular education of special education students, but the formula to calculate reimbursement doesn’t include all the state aid related to special education.

KSDE has not yet published data for the 2022-23 school year, but Lansing was reimbursed for 97% of its special education excess costs in the 2021-22 school year if all funding is counted. The district has a Local Option Budget that allows it to collect 33% of its state aid for special education in extra local property taxes. USD 469 received $3,053,195 in state aid for special education, which it used to extract $1,007,554 in extra local property tax, but the formula doesn’t give the state credit for the extra LOB money.

Department of Education officials don’t know why that line of funding wasn’t written into the formula, and the Legislature should correct the error next year.

Kobza told the board that the district wouldn’t get all the funding for special education students who transferred in under Open Enrollment, but the money is there if the State is credited with all of the funding provided for special education.

These false claims and deceptions are more examples of the education system putting its interests ahead of meeting student needs. School board members and taxpayers deserve to have all the facts so they can make informed decisions that prioritize students.