Ohio Senate includes universal school choice, flatter tax in its budget

(The Center Square) – The Ohio Senate’s version of the state’s next two-year budget includes school choice for all students, removing the power from the State School Board and a flatter tax…

(The Center Square) – The Ohio Senate’s version of the state’s next two-year budget includes school choice for all students, removing the power from the State School Board and a flatter tax code than passed by the House earlier this year.

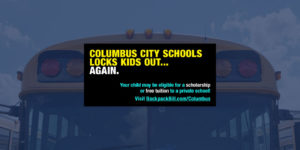

The House’s version, as previously reported by The Center Square, includes more options for school choice but stopped short of funding universal choice and did not include legislation that restructures the education department.

The Senate and the House must reach a budget agreement signed by Gov. Mike DeWine by the end of the month.

The Senate version keeps the current school funding plan and increases public school money over fiscal year 2023 by $1.3 billion. Republican leaders say all districts will receive at least the same amount of money they received this year.

The plan does eliminate $106.8 million going to 36 districts to pay for students who receive state money to attend private schools.

Families who earn 450% of the federal poverty level – $135,000 for a family of four – would qualify for a full school choice scholarship. Families above that threshold will be means-tested with scholarships adjusted based on income. Every student in Ohio would be eligible for at least 10% of the maximum scholarship.

“Parents know what is best for their children,” Senate President Matt Huffman, R-Lima, said in a statement. “Every parent wants the best for their son or daughter, and where they go to school can make all the difference.”

The Senate also included a $1 billion one-time community investment fund for transportation, community plans and projects, eliminating specific pork requests from each district.

“Rather than funding a spectrum of requested district projects, this $1 billion fund gives members in the House and Senate an additional year to plan and craft proposals for meaningful and impactful projects,” said Finance Committee Chairman Sen. Matt Dolan, R-Chagrin Falls.

The Senate also wants to spend $150 million Republicans say will preserve, protect and encourage home ownership, including $50 million for a right of first refusal for land banks to buy foreclosed properties to make them available for families.

There would also be another $50 million in income tax credits for nonprofits that focus on renovations to single-family homes.

“Abandoned and dilapidated homes are more than an eyesore,” Huffman. “They are a missed opportunity to revitalize a neighborhood and put families who need a home in a home.”