Report: Florida is nationwide model for educational freedom and choice

(The Center Square) – The Florida legislature was among several nationwide this year that expanded its school choice programs. One of its scholarship programs is the first of its kind in the…

(The Center Square) – The Florida legislature was among several nationwide this year that expanded its school choice programs. One of its scholarship programs is the first of its kind in the country to help bullied students.

According to a new EdChoice report, seven states enacted new choice programs and 10 expanded existing programs. Florida is now among 10 states that have universal school choice or near universal choice programs.

Florida has four school choice programs: two Education Savings Accounts (ESAs), a tax credit scholarship program, and a Hope Scholarship Program to help bullied students.

Florida’s Family Empowerment Scholarship Program – Unique Abilities ESA – launched in 2014, was recodified in 2021 and was expanded again this year. It allows students with special needs to receive state funded ESAs administered through an approved scholarship funding organization (SFO). Funds can be used to pay for private school tuition, tutoring, online education, home education, curriculum, therapy and other educational services.

Enrollment in the program increased 30% since the last school year with over 85,000 students enrolled in the 2023-2024 school year, according to the report.

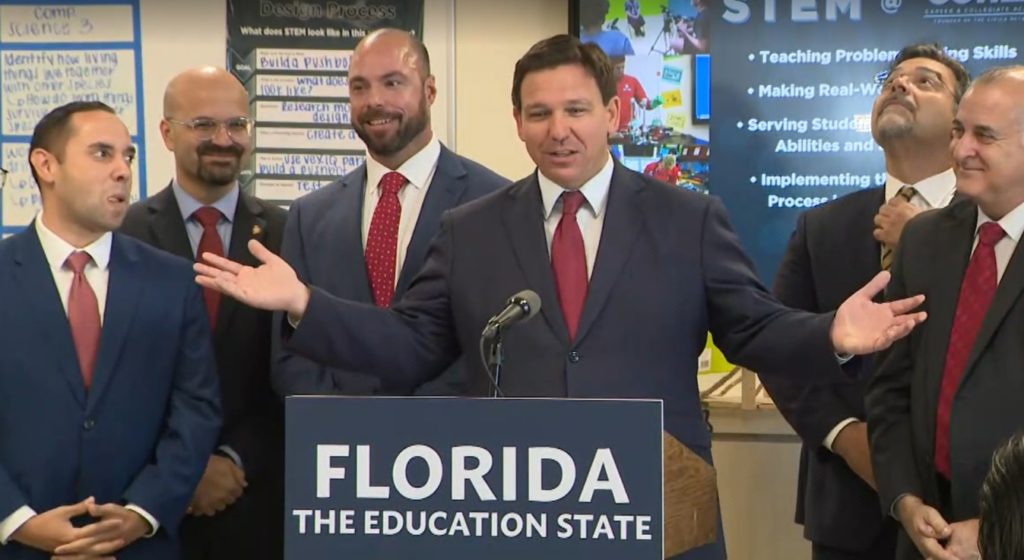

Under Gov. Ron DeSantis, Florida also created the Empowerment Scholarship for Educational Options ESA Program in 2019 to reduce the wait list of the Florida Tax Credit Scholarship Program. Enrollment in the program increased 36% since the last school year with 127,986 participating in the 2023-2024 school year.

“In 2023, Florida policymakers took a giant leap in granting universal ESA access to all K–12 students,” the report states. “Additionally, they converted the Family Empowerment Scholarship Voucher to an Education Savings Account with broadly flexible use for parents.

“Florida is now the nationwide model for educational freedom and choice.”

“The average ESA size is about $9,900, which is comparable to the average student expenditure at Florida’s district schools but still only a portion of the average per-pupil funding for students with special needs at district schools,” the report notes.

Florida’s TCSP provides a tax credit on corporate income taxes and insurance premium taxes for donations made to SFOs and nonprofits that provide scholarships to students, and funds transportation to public schools outside a child’s district. Businesses get a dollar-for-dollar tax credit for SFO contributions, with total credits capped at $873.6 million in 2023–24. Most students received awards averaging $7,800; transportation grants were maxed at $750.

As of 2023, the FTCS program is universally available to all students enrolled in K-12 public schools. Students from families with household incomes of 185% or less of the federal poverty level, foster care students, and students placed in out-of-home care are prioritized.

Under DeSantis, the FTCS program “dramatically expanded student eligibility and allowable expenses, effectively reclassifying the program as a tax-credit education savings account. Florida policymakers also expanded program access by making it available to all families,” the report states.

Statewide, roughly 10% of students participate in one of Florida’s private educational choice options, the report notes, “the highest share of K–12 students participating in private school choice programs in the nation.”

The average scholarship size is about $7,800, which is slightly less than three quarters of the average expenditure per student at Florida’s public schools, according to the analysis. Tax credits are worth 100% of the value of the contributions to scholarship organizations.

Annually, $873.6 million worth of tax credits are available, or 2.9% of Florida’s total K–12 revenue. The tax credit cap increases by 25% each year if at least 90% of the cap was reached in the previous year.

“With the 2023 expansion, Florida has repositioned itself as the national leader for providing robust choice to families. The challenge going forward will be implementation and encouraging participation,” the report states. Participation in the FTCS program is at an all-time high, with a 28% increase from the last school year.

The Florida Legislature also created the Florida Hope Scholarship Program to help bullied or abused students.

Funding comes from those who purchase motor vehicles and choose to donate up to $105 per vehicle of sales tax to the program. Funding is then allocated to organizations and nonprofits providing scholarships to K-12 students who are victims of bullying or violence in public district schools. Qualifying incidents reported by school officials include battery, harassment, bullying, kidnapping, physical attack, robbery, sexual assault, threat and intimidation, assault and fighting in school.

Maximum scholarship amounts range between $6,673 and $7,700 depending on school district and grade level. Students in the program who transfer to an out-of-district public school are eligible for transportation reimbursement up to $750. Scholarships are awarded on a first-come, first-served basis.