Supreme Court upholds tax hike for Louisville public schools

(The Center Square) – Louisville schools will get to increase spending after the Kentucky Supreme Court ruled in favor of Jefferson County Public Schools on a 7-cent property tax rate…

(The Center Square) – Louisville schools will get to increase spending after the Kentucky Supreme Court ruled in favor of Jefferson County Public Schools on a 7-cent property tax rate increase.

The state’s top court ruled unanimously that a petition drive to force a recall vote on the jump on the property tax rate passed by the Louisville school district two years ago did not get enough valid signatures.

Jefferson Circuit Judge Brian Edwards initially threw out the recall vote petition in 2020 after the Jefferson County Teachers Association reviewed petitions and found enough duplicate names or incorrect information to invalidate thousands of signatures. Opponents to the tax hike appealed that decision.

The courts also raised concerns with the security measures taken on the petition, which collected signatures online.

The ballots were printed before the judge’s ruling with the referendum on it, but the ruling means those votes will not be counted.

JCPS enacted the hike, which raised the rate to 80.6 cents per $100 of property value after Edwards’ ruling. However, it held the portion of the funds potentially subject to a recall vote in an escrow account until the courts rendered a final decision. Based on the rate, the district has about $75 million in that account it will now be able to use immediately.

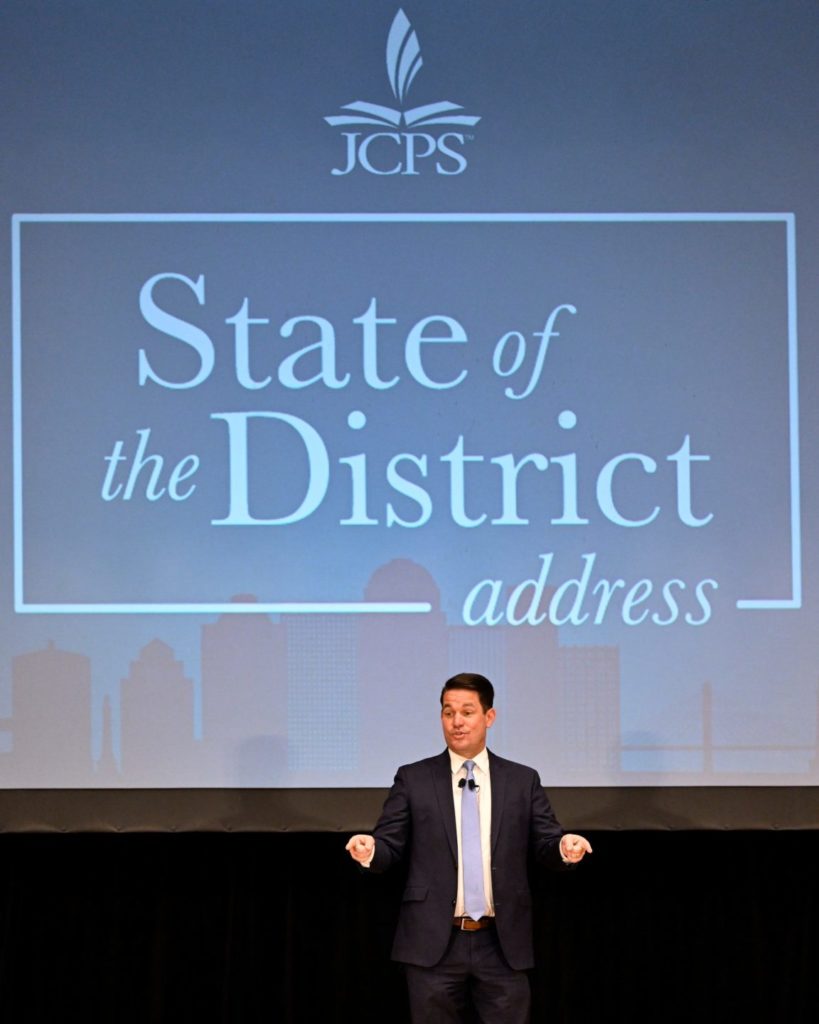

JCPS Superintendent Dr. Marty Pollio hailed the ruling as a victory, saying the district can now make essential upgrades across the county that have long been needed.

“We will be spending that on resourcing our high poverty schools, on our facilities, on our choice-zone students, on extending learning time,” he said. “The things that we are committed to doing here at JCPS along with racial equity initiatives.”

In addition to the additional revenue, Pollio added the tax hike will nearly double the district’s bonding capacity from $265 million to about $525 million.

He said the school system has identified needs that exceed $1 billion. That includes renovating existing buildings and improving athletic and extracurricular facilities.

“I do believe this: That the school building that the child goes to is very symbolic for how much the community cares for the well-being and the education of those students, and they are now going to see very different school buildings than they’ve ever seen before,” Pollio added.

Last year, the Kentucky General Assembly reformed the recall petition process on tax increases. The previous process required organizers to get the signatures of 10% of the district’s registered voters, which meant the 2020 drive needed more than 35,500 signatures. The new process requires only 5,000.

Last year, JCPS adjusted the rate to 79.6 cents per $100.