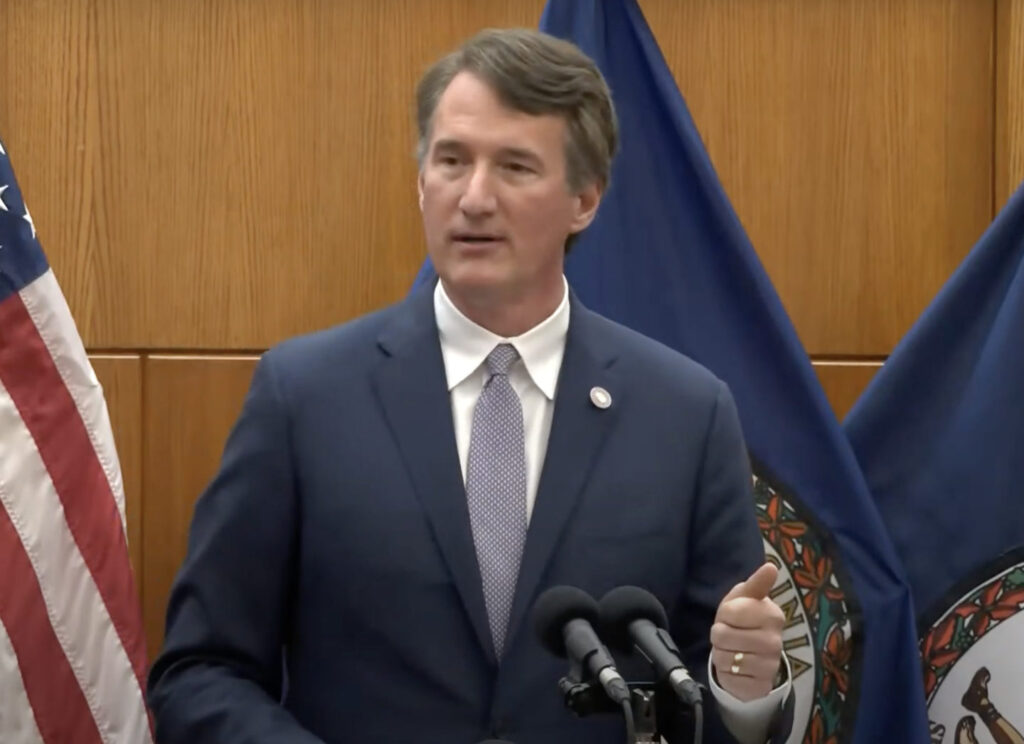

Virginia’s Youngkin proposes gas tax holiday, restores school choice in budget amendments

(The Center Square) – Virginians could pay less for gas over a three-month period and early release of some state prisoners could be delayed if the Virginia General Assembly goes along with those…

(The Center Square) – Virginians could pay less for gas over a three-month period and early release of some state prisoners could be delayed if the Virginia General Assembly goes along with those two and 36 other budget amendments proposed Thursday by Republican Gov. Glen Youngkin.

The bipartisan budget passed earlier this month after several weeks of negotiations between Republicans, who hold a 52-48 edge in the House of Delegates, and Democrats, who hold a 21-19 majority in the Senate. The General Assembly is expected to return to Richmond on Friday to vote on the amendments.

One amendment would create a gas tax holiday that would run from July 1-30. The average price of gas in Virginia is $4.857, according to AAA, below the national average of $5.009.

Youngkin and legislative Republicans proposed bills to temporarily halt the state’s gas tax, which is 26.2 cents per gallon. The plan would have fully eliminated the tax for three months and phased it back in over the next two months, which would have saved taxpayers about $437 million.

Youngkin and Republicans also sought to reduce the gas tax by 5 cents until July 1, 2023, when it would return to its current rate. However, these plans failed to get support from legislative Democrats and ultimately failed in the Senate.

“With five-dollar gas prices and plenty of money in the system, I’m continuing the effort to lower gas prices for hardworking Virginians and my hope is, this time, that Democrats will join us to give Virginians a break this summer,” Youngkin said.

Another amendment restores school choice funding for education scholarship tax credits that was cut by more than half during budget negotiations after lawmakers said the full credit is not used annually.

The Education Improvement Scholarships Tax Credits Program provides a 65% tax credit for individuals or businesses who make donations for scholarships to students so they can attend certain private schools and nonpublic preschool programs. Current law caps the state funding for the program at $25 million per year, but a provision in the budget proposal would reduce that cap to only $12 million per year.

“We’re also restoring educational freedom by protecting the education scholarship tax credits which expand parental choice,” Youngkin said. “Finally, I am asking that the General Assembly help keep our state and federal judges safe. I’m grateful for the hard work of leaders in the House and Senate for presenting a budget to me that delivers key priorities for the commonwealth, these amendments build on that and further our goal to make Virginia the best place to live, work and raise a family.”

Youngkin also proposed amendments that would delay the pending early release of some Virginia prisoners, restrict public funding for abortion, have colleges and universities to develop plans to promote free speech and create a new felony for “intimidating” protests outside of the homes of U.S. Supreme Court justices or courthouses.