With tax cuts ending next year, Americans firmly oppose paying more

(The Daily Signal) – Regardless of who is in the White House come Jan. 20 – whether Donald Trump or Kamala Harris – the next president will face a deadline at the end of 2025 that could…

(The Daily Signal) – Regardless of who is in the White House come Jan. 20 – whether Donald Trump or Kamala Harris – the next president will face a deadline at the end of 2025 that could trigger a tax increase for Americans across all 50 states.

A recent survey by Americans for Prosperity, a grassroots organization that seeks to transform policy around the country, finds that most Americans oppose tax increases.

Polling company Public Opinion Strategies conducted the national survey in September, asking 1,000 likely voters their views about taxes.

Among key findings:

- The Tax Cuts and Jobs Act, passed by Congress and signed into law by Trump in 2017, expires at the end of next year, but only 40% of voters say they have heard a lot or heard some about portions of the law.

- Fully 52% of voters said they support increasing corporate tax rates, while 48% said they oppose it.

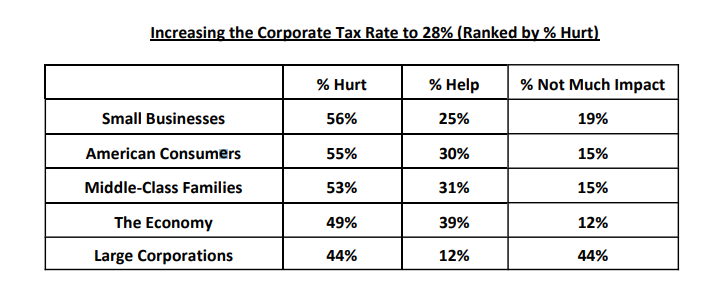

- A majority of voters said they believe that raising the corporate tax rate from 21% to 28% would hurt small businesses, consumers, and middle-class families.

Additional poll findings show that voters would see a failure to extend the 2017 tax cuts as a tax increase and that, out of five groups and sectors, voters said a tax increase would hurt middle-class families the most.

Trump, the Republican nominee, has said he supports extending the tax cuts as one of the landmark accomplishments of his four-year term as president.

Harris, Democrats’ nominee, has voiced support for increasing the corporate rate from 21% to 28% to pay for some of the expanded government programs she’s proposed.

When pressed by “60 Minutes” correspondent Bill Whitaker on how she would pay for her proposals, Harris took aim at the Tax Cuts and Jobs Act.

“There are plenty of leaders in Congress who understand and know that the Trump tax cuts blew up our federal deficit,” the vice president said during the interview, which aired Monday night.

The survey, conducted online from Sept. 5-9, has a margin of error of plus or minus 3.5 percentage points.

Americans for Prosperity’s vice president of communications, Bill Riggs, highlighted the bipartisan nature of likely voters’ sentiment against tax increases.

“In this data … 90% of base Republicans [and] 88% of soft Republicans say it’s a bad time to increase taxes,” Riggs said during a press conference. “But the numbers among Democrats are very high, too: 67% of soft Democrats [and] 62% of base Democrats say it’s a bad time to increase taxes.”

“Soft” Democrats or Republicans are voters who lean toward a party’s philosophy but don’t identify as Democrat or Republican.

Americans for Prosperity is working to educate voters on the effects of a potential tax increase, Riggs said.

The survey reveals that likely voters are less inclined to favor an increase in the corporate tax rate after learning more about the potential effects on the economy.

Before receiving that message, 52% of voters surveyed said they favored the tax rate increase, while 48% said they opposed it. Afterward, 42% said they favored hiking the tax rate and 58% said they opposed it.

With major provisions of the Tax Cuts and Jobs Act set to expire Dec. 31, 2025, Americans for Prosperity’s vice president of government affairs, Akash Chougule, said lawmakers as well as the next president risk burdening Americans with higher taxes.

“Congress has an opportunity to come together to avert crushing tax increases that the American people don’t want by building on the success of the Tax Cuts and Jobs Act,” Chougule said. “Lower taxes are critical to help families keep more of their money and get our country back on the path to prosperity.”